Using a Simple Three-Bucket Approach to Retirement Planning

Have you ever had a financial planner create a “financial plan” for you?

If yes, the chances are high that the presentation showing you the path forward was 20+ pages long. Not only are the typical presentations long, most of them won’t make sense to the average consumer (many cover Monte Carlo testing, Standard Deviation, 95% probabilities of this or that).

Planning for retirement doesn’t have to be complicated

The foundation for a retirement plan can be started by using a simple three-bucket approach. See if you can understand the following and fill in the buckets.

This three-bucket approach is built into the investment risk tolerance software we use. Click here If you would like to find out your personal investment risk score and fill in your own three-buckets (it takes less than five minutes):

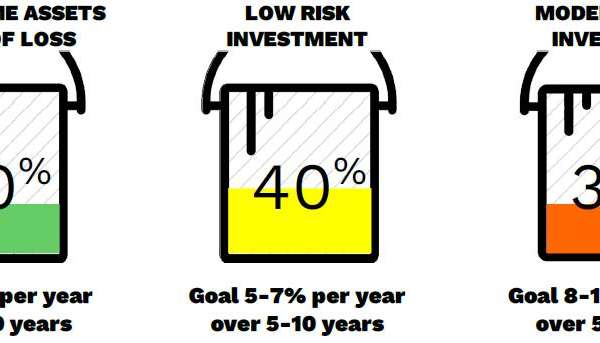

IF YOU WERE TO DIVIDE YOUR INVESTMENT DOLLARS INTO THREE GROUPS,

HOW MUCH WOULD YOU PUT INTO EACH BUCKET?

Please keep this in mind: Historically the S&P 500 has averaged over 8% growth, but sustained multiple losses with some being greater than 50%.

Learning From Numbers

We use careful analysis to sort out the best approach for each client. Using software and human interaction together is powerful when forming a financial plan. Getting the right facts helps us personalize a plan for each clients situation.

Question 1: If you could obtain a 3-5% rate of return with NO risk of loss, how much money would you put in this investment bucket?

Question 2: If you could obtain a 5-7% rate of return with low risk investments, meaning strategies are generally defined as strategies that have a 10-year maximum drawdown of less than 10%, how much would you put in this investment bucket?”

Question 3: If you could obtain 8-10% rate of return with moderate risk investments, meaning strategies that have a 10-year maximum drawdown of 10-20%, how much money would you put in this investment bucket?

The following would be fairly typical of people who answer the above questions.

What would an advisor giving you advice do with the information from above?

Bucket #1 has limited options. You can use CD (Certificate of Deposit) or money market accounts, but the rate of return will be low. Some advisors will recommend FIAs (Fixed Indexed Annuities) which have no risk of loss and lock in the gains typically on an annual basis. These come with a cap on growth with caps around 6% annually right now.

Bucket #2 has more options. Some advisors may use bonds (although buying bonds in a rising interest rate environment can be problematic), some advisors will use an asset allocated blend of bonds and stocks/mutual funds in a mix to meet a certain risk profile, and some will lean on tactically managed strategies to lower risk and generate the expected returns.

Bucket #3 can use a more aggressive mix of stocks, mutual funds, and bonds or a mix of tactically managed strategies with a higher risk profile than those used in bucket #2.

K-I-S-S (Keep It Simple Stupid)

Far too often financial planners put forth very complex offerings that clients have little chance of understanding. The bi-product of this is that clients are not able to make “informed” decisions about how to protect and grow their wealth. The bi-product many times is that clients end up with a mix of assets that is much more risky than what their personal investment risk tolerance would dictate.

With the three-bucket approach, things are simple but there is still sufficient information for the advisor to put together a financial plan that will meet the needs and risk tolerance of clients.

What’s your personal Risk Score?

Again, if you wondered what your personal investment risk score is you can find out by clicking here.

It’s a link to a program that will assess your personal risk capacity and risk tolerance and come up with a unique risk score for you. The program has embedded in it the three-bucket approach discussed on this page.

With a personal risk score we can more easily determine if your current mix of assets is appropriate and/or use it to create a mix that is appropriate.

Creative Solutions

Our goal for each client is to bring all our recourses to bear in an effort to give time-tested solutions for today and beyond.

Professional Team

Our affiliates span the financial landscape. We want to always use client first solutions no matter where we need to turn.

Diverse Approach

We don’t believe in the sales culture, but instead we believe in the service culture. Our approach is to dig in and get to the core issues.

Our Approach

If you would like more information on our three bucket approach and how we use it to help client grow and protect their wealth before and in retirement, please click here to email us or phone 320.980.4036. To sign up for a free consultation, click here.